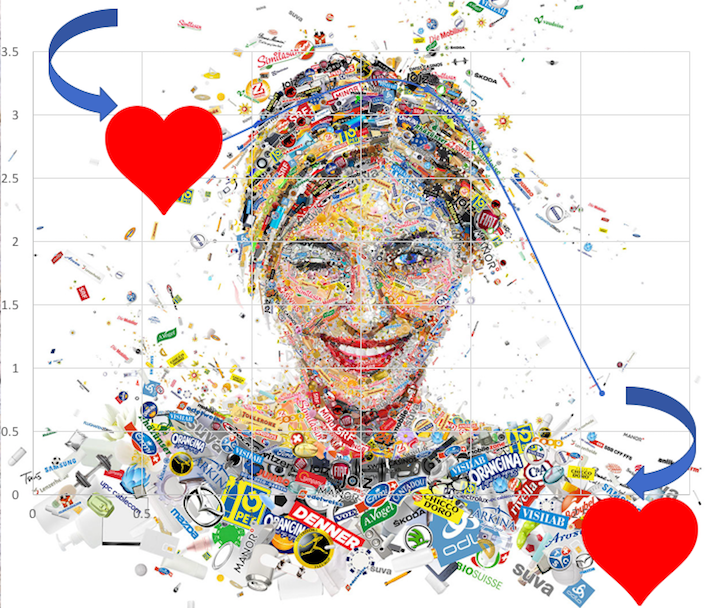

A study by consulting agency Ernst & Young (EY) on the impact of Covid on homemakers says that only about 53 percent of people surveyed checked out a new brand during the pandemic. Of this, only 35 percent liked the new brand and adopted it, while 38 percent went back to the brand they always patronised.

It was never tougher for brand loyalty or notions surrounding the idea. The pandemic forced consumers to switch to other brands and, significantly, stay with their newly adopted brands. An EY study that the agency shared exclusively with The Times of India on the impact of Covid on homemakers, claims that as much as 53 percent bought a new brand during the pandemic. The study, conducted in July-August this year, covers essentials, non-essentials, household cleaning, perishables, and personal-care categories.

EY gathered responses from 385 homemakers from different age groups, family types, and spend categories across various cities in the country. The study reveals that brands will need to necessarily build “strong differentiators” to hold the attention and loyalty of their customers in the wake of a widening consumer basket, allowing the consumer to make alternate choices.

Initially, consumers were seen adjusting

— Shashank Shwet, Ernst & Young Partner, Design Thinking & Digital Transformation

to the lockdown by becoming more flexible and buying new specialty food and DIY items to compensate for lack of entertainment options. This not only force-changed consumer preferences but also paved the way for new product categories with a thrust of localism. Therefore, the switch to new brands was triggered by factors like convenience, availability, and pricing…

In the report, covered by TOI, Ernst & Young Partner (Design Thinking & Digital Transformation) Shashank Shwet says: “Initially, consumers were seen adjusting to the lockdown by becoming more flexible and buying new specialty food and DIY items to compensate for lack of entertainment options. This not only force-changed consumer preferences but also paved the way for new product categories with a thrust of localism. Therefore, the switch to new brands was triggered by factors like convenience, availability, and pricing.”

Shwet further says that for brands to be successful after Covid, it will be critical for them to consistently maintain brand promise with concomitant focus on safety and hygiene, and health and natural foods.

In a report soon after the outbreak of Covid that E&Y had produced titled ‘COVID-19 and the Indian Consumer Responding in a Time of Crisis’, the consultancy had made the following recommendations:

Re-baseline consumer insights

Immediate term:

► Focus on risk mitigation and business continuity

► Proactively set customer expectations regarding changes to product and service offerings

Medium Term:

► Unlearn pre-COVID customer insights and re-learn their expectations and needs to create new segments

► Deepen customer research efforts to understand which segments are impacted in what ways

Empathetic branding

Immediate term:

► Engage with customers through proactive communication and assistance

► Demonstrate organisation’s brand and purpose in communication with customers

► Focus on tracking brand sentiment and conduct analysis driven campaigns

Medium Term:

Communicate with empathy, be responsible with brand promises and promotions

► Use analytics for targeted and relevant marketing

► Enhance digital marketing in B2B

► Prepare for recovery and a planned digital marketing / communication plan

Digital-only

Immediate:

► Build and strengthen E-Com relationships and shift focus to active channels and customer segments

► Monitor regulatory requirements and approvals

► Expand network capacity to handle increased digital demand

► Pivot to identify and assess new revenue streams

Medium:

► Ensure website and digital ordering resilience to eliminate the need of middlemen like dealers, retailers

► Promote self-care and autoticket logging to eliminate the need of contact centres

Remote Collaboration

Immediate:

► Enable “Work from home for sales force” through digital means

► Review all non-value added activities to minimize physical movements/use of low cost automation

► Explore use of emerging technology and automation to reduce people contact and eliminate risk

Medium:

Invest in emerging technologies such as VR for remote product walk-throughs to enhance B2B sales interactions

► Call centre: Seek to partner with external providers for over-flow or accelerated capacity. Tap into the gigeconomy where appropriate

Virtualized sales and service

Immediate:

► Realigning after-sales service to provide best feasible support

► Agile sales team management through beat restructuring, recrafting of roles and clear communication

► Redeploy ASP spends to promote channel liquidity, channel partner loyalty and new channels

Medium:

► Expand network capacity for increased digital sales demand

► Call Centre: Expand resources & access for remote workers to enable a virtual contact centre ► Consider AR or visual search in a repair scenario